Communicate

Bridge communication boundaries with IRBI

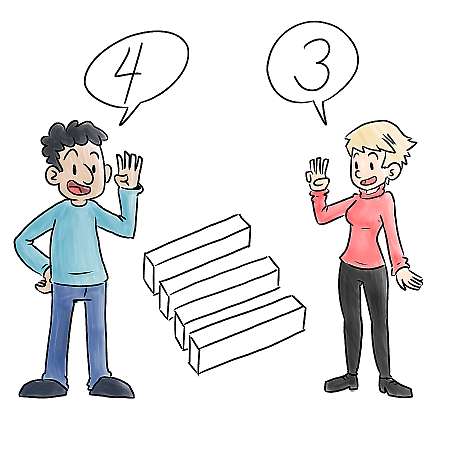

Many organizations are bogged down by gaps in communication due to the diverse backgrounds of the people that work in them. Organizational terminology is often not centrally categorized, and thus is interpreted differently by different members of the organization due to their unique experience and background in the industry. In fact, the most dangerous part of this lack of cohesiveness is that sometimes the communication gap is not even spotted because everyone thinks they share the same understanding of a term or organizational structure when there actually is a severe misalignment. This can reverberate and magnify into problems such as project failure and cause setbacks in progress towards organizational goals.

The IRBI aids in resolving communication problems by primarily relying on a visual approach to organizational models. The visual approach allows organizational members to gain an understanding of overall scope. Also, the fore matter in each chapter preceding the visual charts has a precise description of common organizational terminology, which allows people of different backgrounds within an organization to develop a common understanding of organizational terms.

Key Points:

● Obstacles to communication

○ People have diverse backgrounds, interpret terminology based on their own experiences

○ Everyone tends to interpret based on their background

○ Result is misalignment of understanding/miscommunication/lack of understanding that understanding itself is misaligned

● How the blueprint helps

○ Visual view of all-relevant items on one page - everyone gets complete picuture and cannot be on different page!

○ Description in each term, so that people from different background can develop a common understanding irrespective of their background

Execute

Any business nowadays has an extreme dependence on technology, and this is especially true in the insurance industry, where more and more transactions are relying on computers. This means that technology is a critical part of any insurance process, and executives have to take efforts to ensure technology is available for business efforts.

The IRBI equips executives with the ability to trace the business model of the organization to elements of the information systems model and technology model. This allows executives to greatly simplify the technology aspect of their business transformation features by determining which technological components are crucial to their organization’s operation, which technologies are necessary for pending business efforts, and which technologies are already available in the organization’s application portfolio.

Key Points

● Allows assessment of information technology requirements as part of business transformation planning

● For planning transformation, executives use the blueprint to trace all the way from the Business Model to the Information Systems Model and the Technology Model

Assess and Adjust

Metrics are a hugely important part of defining organizational goals and measuring achievement towards those goals. Without metrics, it is impossible to concretely define “success” and “failure”, and thus projects towards organizational goal achievement often are poorly defined in scope and often go over budget or fail to accomplish their purpose.

The business model of the IRBI places a heavy emphasis on defining and explaining some key strategic measures that are used by CEOs for measuring the progress of their companies at the end of the year. The IRBI also links these measures with business elements (functions, roles, locations, events, data) in order to provide an end-to-end traceability to scope specific business elements that need to be changed in order to produce a positive change in their related metrics. This results in efficiency in business transformation: as only a small fraction of organizational functions affect a measure, time and money are not spent in optimizing functions that do not need to be optimized, and some unnecessary functions can even be marked for removal in this way. This results in the ability for continuous improvement: as transformational efforts no longer require massive expenditures of time and money, the organization can be systematically analyzed via its blueprint for inefficiencies and be improved in punctuated steps over time.

Key Points

Forming a Continuous Improving Program with IRBI

● Metrics are a hugely important part of defining goals and measure achievement towards goals

● Business model of IRBI provides key strategic measures that are used by the executives for measuring progress of their company at the end of the year

● Coupled with end-to-end traceability of metrics with business functions, roles, locations, events, data provides end-to-end visibility to scope items that need to be considered for making a positive impact on those metrics

● If one of the metrics does not hit the mark, it can be traced to via the mapping to functions that need to be addressed for improvement

● Only a small fraction of functions of the organization affect these measures

Convince

Having a blueprint on hand makes it much easier to communicate strategies in both a high-level and a detailed way to stakeholders. The high-level description of a strategy is critical to providing a summary of a business transformation effort, but without details, it can be difficult to convince stakeholders to buy into the idea since its implementation comes off as fuzzy and indeterminate. Conversely, a strategy that is communicated with all the required details (technology buys, process improvements, etc.) appears very well-defined to stakeholders, making it easy to convince them.

Blueprint supplies all of the required details to the executives in terms of what, why, how, who, when and where.

Key Points

● With all the details in hand, communicating strategies is easier

Any strategy is communicated with all the required details (technology buys, process improvements, etc.), making it easy to convince stakeholders

Blueprint supplies all of the required details to the executives in terms of what, why, how, who, when and where.